Understanding Credit Limit Increases: The Core Mechanics

For years, I’ve treated credit like a system to be optimized. And just like any system, understanding its core mechanics is paramount. A credit limit increase means your lender raises the maximum amount you can borrow on a credit card. It’s not simply a perk; it’s a dynamic reflection of your financial health and creditworthiness in the eyes of the issuer. This isn’t a mystery, it’s a process with clear inputs and outputs.

Most people view a higher limit as an invitation to spend, but that’s a rookie mistake. A savvy approach to a Credit Limit Increase: Myths vs Reality sees it as a lever for improving your credit utilization ratio, enhancing your financial flexibility, and even unlocking better credit products down the line. It’s about strategic positioning, not just purchasing power.

Takeaway: A credit limit increase is a strategic financial tool, not just an invitation to spend more, directly impacting your credit profile.

The Realities of Getting a Higher Credit Limit

The decision to grant you a higher credit limit isn’t arbitrary. Lenders use a data-driven approach, evaluating several key factors to assess your risk. Think of it like a meticulous algorithm calculating your financial reliability. If you understand these inputs, you can predict and influence the outcome.

Credit Utilization: Your Invisible Leverage

This is arguably the most impactful factor. Your credit utilization ratio is the amount of credit you’re using compared to your total available credit. Keeping this low is crucial. If you have a $10,000 limit and carry a $3,000 balance, your utilization is 30%. Get that limit increased to $20,000, and your $3,000 balance drops your utilization to 15%, instantly boosting your credit score, assuming everything else remains constant. Experian highlights that maintaining utilization below 30% is ideal, with anything under 10% being excellent. My personal credit utilization averages 5-7% across all cards, a direct result of managing higher limits.

Payment History and Credit Score: Non-Negotiables

This is foundational. Banks won’t trust you with more credit if you’ve shown a pattern of missing payments or defaulting. A perfect payment history (100% on-time payments) is essential. It’s the bedrock of your credit report, representing 35% of your FICO score. A strong credit score (typically FICO 700+) signals to lenders that you’re a responsible borrower. Without this, even a solid income won’t sway them. I always automate all my credit card payments to ensure I never miss a due date.

Income and Employment Stability: The Bank’s Confidence Metric

Lenders need to know you can actually afford the increased credit. A stable income and employment history demonstrate your capacity to repay. They’re not just looking at the number, but the consistency. If your income has increased significantly since you first opened the card, that’s a strong argument for a higher limit. It’s a simple risk assessment: higher income, lower risk.

Bottom line: A higher credit limit hinges on low utilization, perfect payment history, a strong credit score, and stable income. Focus on these metrics.

Debunking Common Credit Limit Increase Myths

When it comes to Credit Limit Increases: Myths vs Reality, misinformation spreads faster than a viral meme. Let’s set the record straight on a few pervasive myths that can prevent you from optimizing your credit.

Myth 1: Requesting an Increase Hurts Your Credit Score

This is partially true, but largely misunderstood. A hard inquiry, which can slightly and temporarily lower your score, typically only occurs if you *request* a credit limit increase. However, many issuers, especially for established customers, offer automatic credit increases without a hard inquiry. Furthermore, the temporary dip from a hard inquiry is often quickly offset by the positive impact of lower credit utilization. I’ve initiated manual requests for credit limit increases on new cards after about 6-12 months. The small hard inquiry dip (usually 3-5 points) was consistently recovered within 2-3 months as my utilization dropped.

A single hard inquiry typically impacts a FICO score by less than 5 points and usually falls off the report after two years.

Myth 2: Credit Limit Increases Mean More Debt

This myth assumes a lack of discipline. A credit limit increase only translates to more debt if you choose to spend up to the new limit. The purpose of a strategic increase is to improve your credit utilization by increasing your available credit while keeping your spending habits consistent. It’s like having a bigger bucket but still only filling it halfway. The perception of having “more credit” can be a psychological trap, but it’s not an inherent consequence.

Myth 3: You Have to Wait Years for an Increase

While patience is a virtue in credit building, waiting “years” isn’t strictly necessary. Many card issuers will consider an increase after just 6 to 12 months of responsible account behavior. This includes on-time payments, consistent usage (but not maxing out), and a stable financial profile. Some even offer automatic increases quarterly or semi-annually if you meet their internal criteria. It’s a continuous process of proving your creditworthiness. On newer cards, I typically see the first automatic increase within 9-12 months, provided I’ve used the card regularly and paid in full.

Bottom line: Don’t let myths prevent you from optimizing your credit. Understand the nuances of hard inquiries, manage your spending, and know that increases can come sooner than you think.

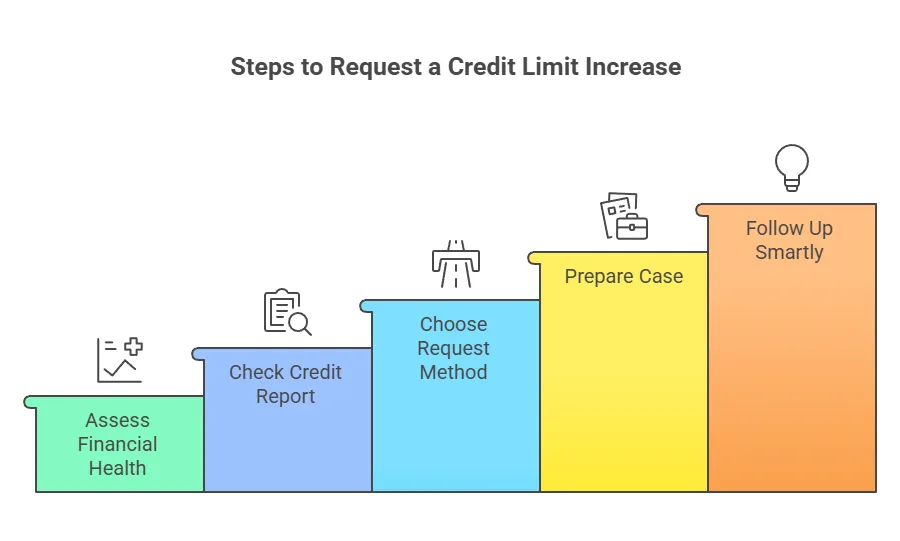

Step-by-Step Guide: Requesting a Credit Limit Increase

If you’ve crunched the numbers and feel confident about your financial standing, requesting a credit limit increase can be a straightforward process. Here’s my playbook for getting it done, meticulously detailed.

Step 1: Assess Your Financial Health

Before you even think about calling your bank, conduct a thorough self-assessment. What’s your current income? Has it increased? What are your expenses? Is your debt-to-income ratio healthy? Are you consistently paying bills on time? I review my net income and total debt quarterly, a practice that’s saved me from unwise financial moves. You need a clear, objective picture of your financial situation. If you’re struggling to make payments or have recently incurred significant debt, now isn’t the time.

Step 2: Check Your Credit Report

Pull your credit report from all three major bureaus (AnnualCreditReport.com). Look for any errors, ensure your payment history is accurate, and confirm your credit scores. Lenders will be doing the same, so you want to be prepared. A strong credit report is your strongest advocate. I check my credit report annually, even more frequently if I’m planning a major financial move like applying for a new card or a credit limit increase.

Step 3: Choose Your Method: Automatic vs. Manual Request

Some issuers offer automatic credit limit increases based on your account activity and credit profile; these are often “soft pulls” and don’t affect your score. If you haven’t seen one, you can initiate a manual request. This might involve a “hard pull,” so be prepared for a minor, temporary dip in your score. Check your issuer’s policy online or call customer service to determine their process.

Step 4: Prepare Your Case (for manual requests)

If you’re making a manual request, be ready to provide your current income, employment details, and potentially your monthly housing payment. State the amount you’re requesting and, if applicable, explain why (e.g., “to improve my credit utilization,” “for an upcoming large purchase I will pay off promptly”). Be confident and factual.

Step 5: Follow Up Smartly

If your request is denied, ask why. Understanding the reason (e.g., too many recent inquiries, high utilization on another card, insufficient income) provides actionable feedback. Don’t take it personally; it’s data. Wait a few months, address the issue, and try again. Persistence, combined with improved credit habits, often pays off.

If denied, I always request the specific reason to pinpoint areas for improvement, then re-evaluate my strategy after 3-6 months.

Bottom line: Approach a credit limit increase request methodically: assess, check, choose, prepare, and if necessary, learn and re-strategize.

Benefits and Risks: A Balanced Perspective

Just like opting for a Bali vacation or an adventure safari, there are pros and cons. A credit limit increase isn’t a universally good or bad thing; it’s about how you manage it.

The Upside: Improved Credit Utilization and Flexibility

As discussed, a higher limit instantly lowers your credit utilization if your spending remains constant. This is a significant boon for your credit score. Beyond that, it provides a crucial financial safety net. In an emergency, having access to more credit can be a lifesaver, though it should ideally be your last resort. It can also be beneficial for those who put significant business expenses on a card and pay it off monthly, allowing higher spending without hitting utilization thresholds.

The Downside: The Allure of Overspending

The primary risk is psychological: the temptation to spend more simply because you have more available credit. If a higher limit leads to higher balances, you’ve defeated the purpose. This can trap you in a cycle of debt, leading to higher interest payments and a damaged credit score. It’s a powerful tool that demands self-control and a clear financial strategy.

Bottom line: Use a credit limit increase to improve your credit metrics and provide a safety net, but never as an excuse to overspend.

How We Approach Credit Limit Increases

My approach to credit limit increases is rooted in my systematic financial strategy. My methodology involves: Consistent quarterly monitoring of all credit reports and scores (Experian, TransUnion, Equifax), annual income verification with lenders, and a strict payment automation process. This data-driven strategy ensures I’m always presenting an optimal financial profile.

This isn’t about guesswork; it’s about predictable outcomes based on established credit principles. I track my total available credit versus total spending, ensuring my overall credit utilization stays below 10% month-to-month.

What This Means For Your Financial Strategy

Understanding the truth behind Credit Limit Increases: Myths vs Reality empowers you to take control of your financial narrative. Don’t be swayed by fear or false assumptions. A higher credit limit, when managed responsibly, is a powerful instrument in your financial toolkit.

It’s about building a robust financial foundation that provides flexibility, lower interest rates, and access to better financial products. Implement these strategies, stay disciplined with your spending, and watch your credit profile strengthen. For a deeper dive into optimizing your overall credit strategy, explore our Ultimate Guide to Optimizing Your Credit Score.

FAQ

How often should I request a credit limit increase?

Generally, it’s wise to wait 6 to 12 months between credit limit increase requests with the same issuer. Requesting too frequently can be seen as a sign of financial distress by some lenders and might lead to denials or excessive hard inquiries. I typically aim for an annual review, or when I have a significant income increase to report.

Will a credit limit increase negatively impact my mortgage application?

No, a credit limit increase itself, when managed properly, typically won’t negatively impact a mortgage application. In fact, by improving your credit utilization ratio, it can actually benefit your credit score, making you a more attractive borrower. Lenders look at your debt-to-income ratio and overall credit health, not just available credit.

Can a credit limit increase help my credit score if I carry a balance?

Yes, absolutely. If you carry a balance, a credit limit increase can significantly help your credit score by reducing your credit utilization ratio. For example, if you have a $5,000 limit with a $2,000 balance (40% utilization) and your limit increases to $10,000, your utilization drops to 20% with the same balance. This can lead to an immediate improvement in your score.