Part 1: Deconstructing the Algorithm – What is Credit Utilization?

Think of your total available credit as your system’s maximum server capacity. Your credit utilization is the real-time “load” on that server. A server constantly running at 90% capacity is a high-risk system, prone to crashing. A server running at 10% is stable and healthy. Lenders view your credit reliance in exactly the same way.

This “load” is calculated with a simple formula that is a cornerstone of both the FICO and VantageScore credit scoring models:

Credit Utilization Ratio = (Total Reported Balances ÷ Total Credit Limits) × 100

This single number makes up the largest part of the “Amounts Owed” category, which accounts for a massive 30% of your entire FICO score. Unlike slower-moving factors like your “Age of Credit History,” utilization is hyper-volatile. It has no memory. A high utilization last month has zero effect on your score this month if you’ve since paid it down. This volatility makes it your single most powerful tool for short-term score optimization.

The Data Points: Understanding the Utilization Tiers

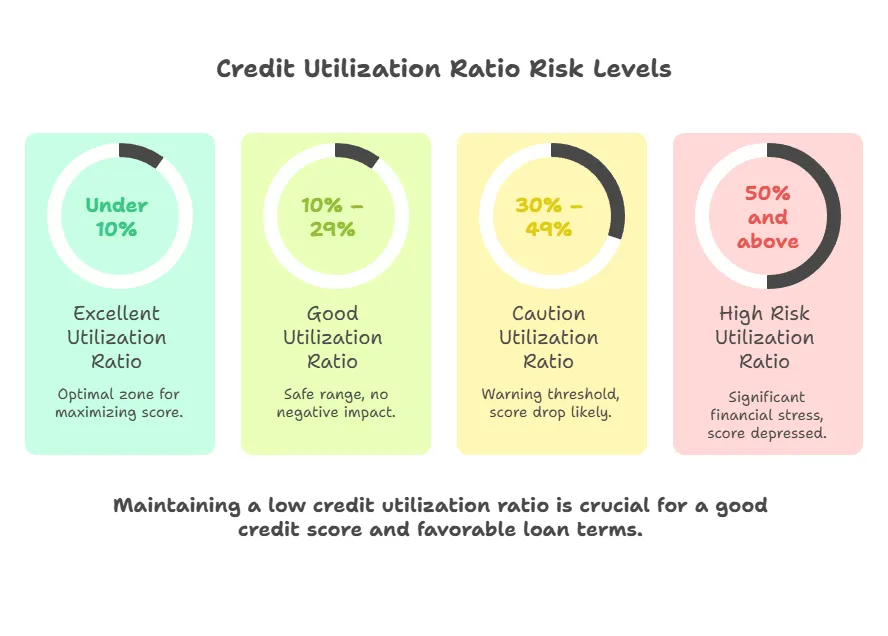

Scoring algorithms group utilization into risk tiers. Understanding how lenders interpret your data at each level is critical for strategic planning.

| Utilization Ratio | Risk Level | Lender’s Interpretation & Impact |

|---|---|---|

| Under 10% | Excellent | You use credit as a tool, not a crutch. This is the optimal zone for maximizing your score and getting the best loan offers. |

| 10% – 29% | Good | You are a responsible credit user. This range is generally considered safe and will not negatively impact your score. |

| 30% – 49% | Caution | This is a warning threshold. Crossing 30% signals to lenders that you may be becoming over-reliant on credit, likely causing a score drop. |

| 50% and above | High Risk | This signals significant financial stress. A ratio in this range is almost certainly depressing your credit score significantly. |

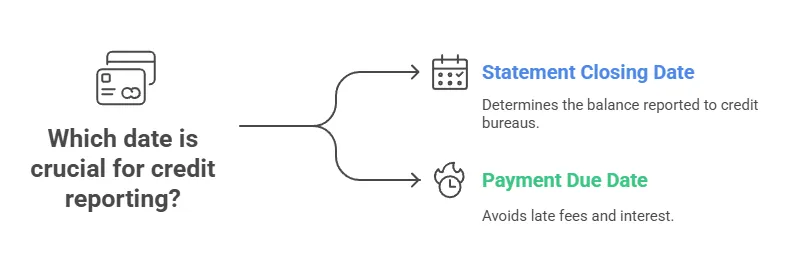

Part 2: The Most Critical Concept – Statement Date vs. Due Date

This is the single biggest point of confusion for beginners, and mastering it is non-negotiable. Most people believe that as long as they pay their bill by the due date, their balance is reported as zero. This is incorrect.

- The Statement Closing Date: This is the last day of your billing cycle. The balance on your account on this date is what your credit card issuer reports to the credit bureaus.

- The Payment Due Date: This is the deadline by which you must pay your bill to avoid late fees and interest. It is usually about 3-4 weeks after your statement closing date.

The Ultimate Strategy Guide to Lower Your Credit Utilization

Here are the most effective, actionable methods to optimize your utilization ratio, ranked by impact. These are the levers you can pull to control the system.

Strategy #1: The Pre-Payment Method

This is the core tactic. Log into your credit card account 3-5 business days before your statement closing date and make a payment to reduce the balance to under 10% (or to zero). This ensures a low utilization figure is reported to the credit bureaus for that month, directly boosting your score.

Strategy #2: Request a Strategic Credit Limit Increase (CLI)

Increasing your total credit limit is a powerful way to lower your ratio without changing your spending. Most banks offer a “soft pull” CLI request online, which doesn’t affect your score. The best time to ask is after 6-12 months of consistent on-time payments. A simple increase from a $10,000 limit to a $15,000 limit instantly changes a $3,000 balance from 30% utilization to 20%.

Strategy #3: Open a New Credit Card (with caution)

Opening a new card adds its credit limit to your total available credit, which can significantly lower your overall utilization. While this comes with a temporary score dip from the hard inquiry, the long-term benefit of a higher limit is often worth it. For those in the travel rewards world, this must be balanced with rules like Chase’s 5/24 rule and choosing from the best available travel credit cards.

Strategy #4: The “AZEO” Method for Major Applications

For those preparing to apply for a major loan like a mortgage, an advanced technique is “AZEO” – All Zero Except One. This means paying off the balances on all your credit cards to report $0, except for one card where you let a very small balance (e.g., $5) report. This shows you are an active credit user but not a reliant one, and it’s a known method for maximizing your score right before an application.

Common System Faults: Myths and Mistakes to Avoid

Misinformation can be costly. Here are the facts to counter common myths.

- Myth: “You need to carry a balance to build credit.” This is the most damaging myth in personal finance. You never need to pay interest to build credit. Paying your statement in full every month is the goal and a core principle of building your credit score the right way.

- Mistake: Closing an old credit card. Closing a no-annual-fee card is usually a mistake. You lose that card’s credit limit, which can cause your overall utilization to spike, and you stop the account from aging, which hurts your credit history length.

- Myth: “Debit cards are better because they avoid debt.” While true that they prevent debt, they do absolutely nothing to build your credit history. Using a credit card responsibly as if it were a debit card (paying it in full) is the optimal strategy for building a strong score.

Conclusion: You Are in Control of the System

Your credit utilization ratio is not a passive number that happens to you; it is an active metric that you can directly control. By understanding the system’s simple rules—the importance of the statement date, the 30% threshold, and the power of proactive payments—you can turn this crucial scoring factor into your greatest asset.

Treat it like any other system you want to optimize. Monitor your inputs (balances), manage your capacity (credit limits), and you will achieve your desired output: a higher credit score, better financial products, and lasting peace of mind.

Frequently Asked questions

How quickly will my credit score improve after I lower my utilization?

The impact is very fast. Because utilization has no “memory,” your score will be recalculated as soon as the lower balance is reported by your issuer (typically once per month). You can see a significant score increase in as little as 30 to 45 days after implementing these strategies.

Do loans like mortgages or car loans count towards my credit utilization?

No. Credit utilization specifically refers to your revolving credit accounts (primarily credit cards). Installment loans like mortgages, auto loans, and personal loans are treated differently in your credit score and do not factor into your utilization ratio.

Is it bad to have 0% utilization reported on all my cards?

It’s not “bad,” but it’s not optimal. Lenders like to see that you are an active and responsible credit user. Reporting 0% on all cards can sometimes lead to a slightly lower score than reporting a very small balance (e.g., 1%) on one card. This is the principle behind the advanced “AZEO” strategy.