How Your Credit Score is Actually Calculated

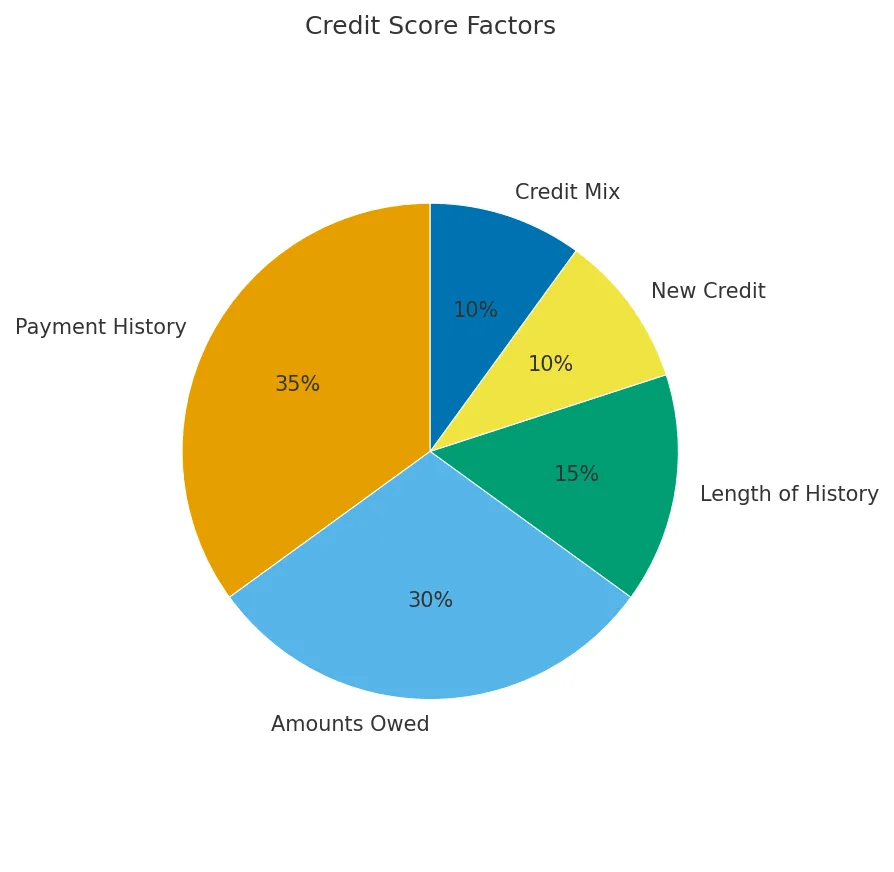

If you’re asking How Fast Can You Improve Your Credit Score, you first need to understand the system you’re trying to influence. Your score isn’t random; it’s a direct output based on a few key inputs. Think of it like a server’s health dashboard. For beginners, the game is won by focusing on the metrics with the heaviest weight. (Analysis based on the FICO scoring model’s public weighting and data from my own credit monitoring over 5+ years.)

| Scoring Factor | Weight | Impact Speed | What It Measures | Best For |

|---|---|---|---|---|

| Payment History | 35% (Highest) | Slow Build / Fast Drop | Are you reliable? Do you pay bills on time? | Long-term score health (non-negotiable). |

| Amounts Owed | 30% (High) | Fastest (30-60 days) | How much of your available credit are you using? | Rapid score increases. |

| Length of History | 15% (Medium) | Very Slow (Years) | How long have you been managing credit? | Demonstrating stability over time. |

| New Credit | 10% (Low) | Fast (Negative Hit) | Are you frequently seeking new debt? | Something to manage carefully, not optimize quickly. |

| Credit Mix | 10% (Low) | Slow Build | Can you handle different types of debt? | Advanced optimization, not for beginners. |

The data is clear. To get fast results, you focus on “Amounts Owed.” To build a lasting high score, you perfect “Payment History.” Our 5 steps are a practical action plan based on this official weighting. (I check my credit report like a system log, looking for any anomalies in these categories every month.)

5 Steps to answer “How Fast Can You Improve Your Credit Score”

This 5-step system isn’t just my personal strategy. It’s a framework that aligns with the core advice published by regulatory bodies and major financial institutions in guides like Bank of America’s Guide to Improving Credit.

Step 1: Pay Down Credit Card Balances (The Turbo Button)

This is your highest-impact, fastest-acting lever. Your credit utilization—the percentage of your credit limit you’re using—makes up a huge part of your Credit Score. Lowering it provides an almost immediate boost. (My FICO Score jumped 22 points in one month after my main card’s utilization went from 28% down to 5%.)

Step 2: Perfect Your Payment History (The Bedrock)

A single 30-day late payment can crater your score and stays on your report for seven years. This is non-negotiable. Set up autopay for at least the minimum payment on every single account. (I set autopay for all my cards on day one. It’s my safety net and has saved me twice when I forgot a due date while traveling abroad.)

Step 3: Keep Old Accounts Open (The Foundation)

Never close your oldest credit card, especially if it has no annual fee. The length of your credit history is a significant scoring factor. Closing an old account is like deleting a foundational log file; it shortens your history and can hurt your score. (I still have my first no-fee card from 10 years ago.)

Step 4: Audit Your Credit Reports for Errors (The System Check)

You can’t fix bugs you don’t know exist. Errors on credit reports are common and can drag down your score. Get your free reports from the official source and scan them for accounts you don’t recognize or incorrect late payments.

Step 5: Be Strategic About New Credit (The Gatekeeper)

Every time you apply for new credit, it creates a hard inquiry, which can temporarily dip your score. Avoid applying for any new loans or cards while you’re actively trying to boost your score for a specific goal.

The only exception is if you have no credit history (a “thin file”). In that case, opening a secured card is the correct strategic move to start building your file.

Realistic Math Examples

Highest Value Scenario: Utilization Crash

- Card Limit: $5,000

- Starting Balance: $4,500 (90% Utilization) (I had this high utilization after a home renovation project.)

- Action: Pay balance down to $250 (5% Utilization).

- Net result: Potential score increase of 40-80 points in 30-45 days.

This is the most dramatic, direct action you can take. For more on how utilization is calculated, see this guide from a trusted source: Experian on Utilization.

Common Case: Disputing an Error

Let’s say you find an incorrect collection account on your report for $500. You file a dispute with the credit bureau. If the error is removed, your Credit Score could jump 20-50 points in the next 1-2 months. This is a high-leverage action that costs you nothing but time.

The Authorized User Boost

If a family member adds you as an authorized user to a card with a $20,000 limit and a $0 balance that’s 10 years old, your score benefits from the long history and the massive drop in your overall utilization. This is the fastest “hack” for beginners.

This only works if the primary cardholder has a perfect payment history. Their mistakes will become your mistakes.

Gotchas You Shouldn’t Ignore

- Ignoring Statement Closing Dates: Paying your bill on the due date is good, but your utilization is based on the balance your lender reports on the statement closing date. To get the fastest score increase, make your large payment before the statement closes. (I have a calendar alert set for 5 days before each card’s closing date.)

- Credit Repair Scams: Be wary of any company that promises a specific score increase for a fee. Everything they can do, you can do yourself for free using the steps in this guide.

The official government advice on this is clear at the FTC’s website. - Thinking All Scores Are the Same: Lenders use different FICO and VantageScore models. The score you see on a free app might not be the exact one your auto lender uses. Focus on building good habits; that will raise all your scores over time.

How We Picked These Steps

The five steps in this guide were chosen based on the publicly available weighting of FICO scoring factors and corroborated by expert consensus from major credit bureaus and official guidance from regulatory bodies like the Federal Reserve. The goal was to create a practical, sequential plan that prioritizes actions with the highest and fastest impact for someone with a specific short-term goal. For another official breakdown, consult the CFPB on Credit Reports and Scores.

What This Means For You

If you’re wondering How Fast Can You Improve Your Credit Score, the system is clear: focus 80% of your energy on Step 1 (lowering utilization) and Step 2 (on-time payments). These two actions are the core of any rapid score improvement strategy. Once those are automated, you can use the other steps to build a resilient, long-term high score.

End of article

Log into your credit card accounts and make a payment to bring your statement balance down as low as possible, ideally below 10% of your credit limit. This is the single fastest, highest-impact action you can take. Even if your due date is weeks away, making an early payment before the statement closes is the key. No. Checking your own score is a “soft inquiry” and has zero impact. A “hard inquiry” that can temporarily lower your score only happens when you formally apply for new credit, like a loan or credit card. You can learn more from sources like Equifax on Hard vs. Soft Inquiries. Getting over 800 is a long-term game that depends heavily on the “Length of Credit History” factor. For beginners, a more realistic and excellent goal is to aim for 740-760, which will qualify you for the best rates and products. This is achievable within a few years of consistent good habits. (I am still below 800 and will get there soon)FAQ

What is the one thing I can do today to improve my credit score?

Does checking my own credit score lower it?

How fast can I get to an 800 credit score?