Why You Can’t Just “Merge” Airline Miles

Let’s clear the biggest misconception first. Airline loyalty programs are walled gardens. They are designed to keep you loyal to one airline. For this reason, directly transferring miles from one airline program to another (e.g., United MileagePlus to Delta SkyMiles) is almost never possible. And in the rare instances where a third-party service allows it, the exchange rates are so poor it amounts to financial malpractice.

Think of your miles as distinct currencies. You wouldn’t expect to trade 100 Japanese Yen for 100 U.S. Dollars. The same logic applies here. Forgetting this rule is the fastest way to destroy the value you’ve worked hard to earn.

The real question isn’t “how do I move miles from Airline A to Airline B?” The correct, strategic question is: “How do I consolidate purchasing power from multiple sources into a single airline program to book a specific award?”

The Core Concept: Value-Based Transfers

The entire game of combining miles hinges on one principle: transferring points from a high-value, flexible currency to a specific airline program at a favorable ratio. To do this, you must understand what your points are worth. Losing value happens when you transfer points worth 1.8 cents each to an airline where they might only yield 1.2 cents in value on your chosen redemption.

Here’s a simplified valuation table of just a few we valued on Pointalize.

| Program | Estimated Value (CPP) | Primary Strength |

|---|---|---|

| Chase Ultimate Rewards® | ~2.0 cents | Strong 1:1 airline & hotel partners (e.g., Hyatt, United). |

| Amex Membership Rewards® | ~2.0 cents | Largest list of 1:1 airline transfer partners. |

| Capital One Miles | ~1.8 cents | Simple earning structure and good airline partners. |

| Air Canada Aeroplan | ~1.5 cents | Access to Star Alliance partners with no fuel surcharges on many. |

| American AAdvantage | ~1.5 cents | Valuable Oneworld partner redemptions. |

| Marriott Bonvoy | ~0.7 cents | Excellent for hotel stays; use for airline transfers cautiously. |

The 4 Methods for Combining Miles (Effectively)

Now, let’s get to the actionable strategies. These are the systematic approaches to pool your rewards without setting their value on fire.

Method 1: Use Flexible Credit Card Points (The Central Hub Strategy)

This is the most effective and efficient strategy. Flexible point currencies from credit cards (like Chase Ultimate Rewards, Amex Membership Rewards, Capital One Miles, and Citi ThankYou Points) are the key. These programs have agreements with numerous airlines, allowing you to transfer your points, usually at a 1:1 ratio.

Here’s the step-by-step process:

- Identify Your Award: Find the specific flight you want to book on an airline’s website. For example, a business class ticket to Europe on Air France for 70,000 miles.

- Check Transfer Partners: Air France’s Flying Blue program is a transfer partner of Chase, Amex, Capital One, and Citi. This means you can funnel points from any of those programs into your Flying Blue account.

- Consolidate Your Points: Let’s say you have 40,000 Amex points and 30,000 Chase points. You can transfer both balances to your Flying Blue account to reach the 70,000 miles needed for the ticket.

- Execute the Transfer & Book: Log into your Amex and Chase accounts, link your Flying Blue account, and initiate the transfers. Most transfers are instant, but some can take time. Once the miles land, book your award flight immediately.

I remember booking a last-minute trip on ANA First Class. I had points scattered across my Amex and Marriott accounts. By moving 90,000 points from Amex and topping it off with a 60,000-point transfer from Marriott (which became 25,000 airline miles), I was able to consolidate them into my Virgin Atlantic account and book the seat. Without this strategy, those points would have been useless for that goal.

Method 2: Leverage Hotel Program Transfer Partners

Hotel loyalty programs can serve as a secondary hub, though their transfer ratios are often less favorable. The most notable is Marriott Bonvoy, which partners with 38 airlines.

Most transfers are at a 3:1 ratio (3 Marriott points = 1 airline mile). However, Marriott adds a 5,000-mile bonus for every 60,000 points you transfer. So, 60,000 Bonvoy points become 25,000 airline miles (20,000 from the transfer + 5,000 bonus). This makes the effective ratio 2.4:1, which can be strategic for topping off an account for a high-value redemption.

For their preferred partner United they add 10,000-mile bonus when transferring 60,000 Bonvoy points.

When to use this: Only use this method to bridge a small gap in your airline account or if you have a massive balance of hotel points you don’t plan to use for stays.

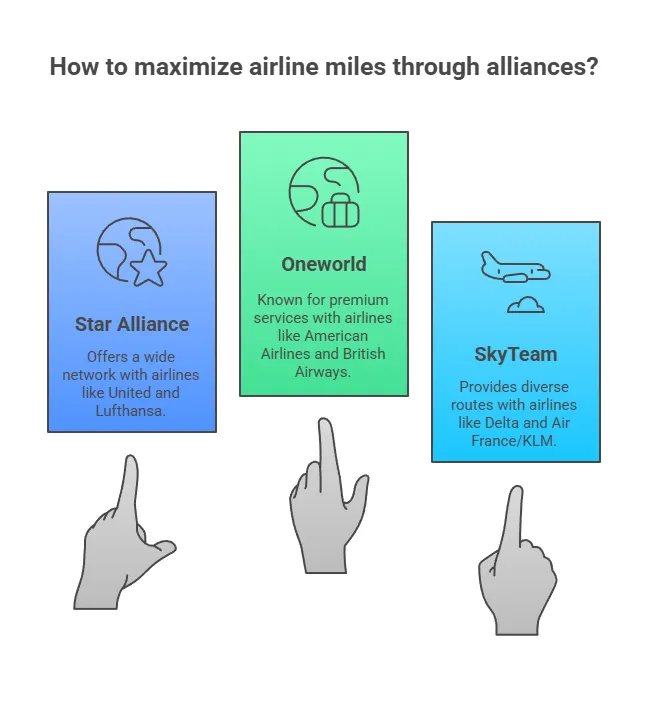

Method 3: Book Partner Awards Through Airline Alliances

This is an “indirect” way of combining power. You can’t move miles between alliance partners, but you can use one airline’s miles to book a flight on a partner airline.

The three major airline alliances are:

- Star Alliance: (United, Lufthansa, Singapore Airlines, Air Canada, etc.)

- Oneworld: (American Airlines, British Airways, Cathay Pacific, Qantas, etc.)

- SkyTeam: (Delta, Air France/KLM, Korean Air, etc.)

For example, if you have a large balance of United MileagePlus miles, you can use them to book a flight operated by Lufthansa. You don’t need any Lufthansa miles. This is powerful because some programs offer better redemption rates for the exact same partner flight. Your research here can save you tens of thousands of miles.

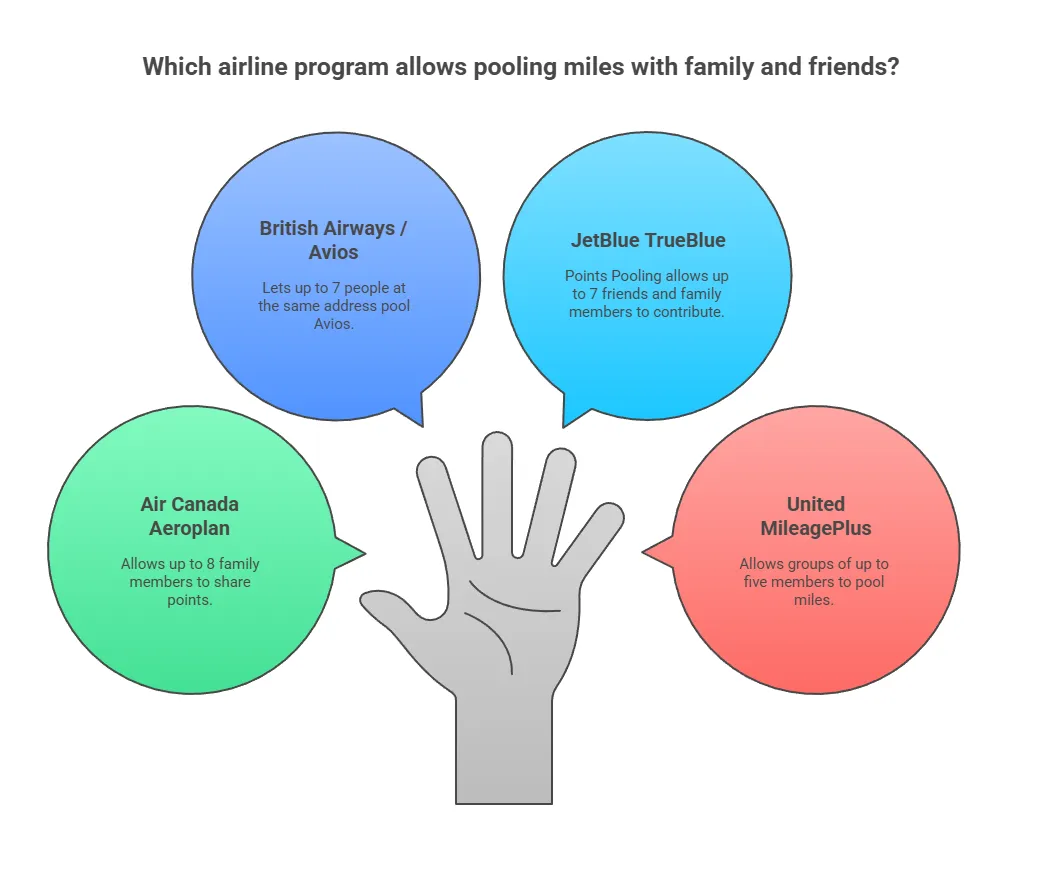

Method 4: Pool Miles with Family and Friends

A few airline programs allow you to create a “family pool” where multiple members can combine their miles into a single account for free. This is true mileage combination, but it’s limited to specific programs.

- Air Canada Aeroplan: Allows up to 8 family members to share points.

- British Airways / Avios: Their “Household Account” lets up to seven people at the same address pool Avios.

- JetBlue TrueBlue: Points Pooling allows up to 7 friends and family members to contribute.

- United MileagePlus: Allows groups of up to five members to pool miles.

If you and your travel companions frequently fly these airlines, setting up a pool is a zero-cost way to consolidate your earning power. If you need more info on maximizing your current points, check out our guide to point valuations and how to maximize points and miles.

Critical Mistakes That Destroy Mile Value

- Transferring Speculatively: Never transfer points from a flexible currency to an airline “just in case.” Transfers are one-way and irreversible. If the award availability disappears or the airline devalues its chart, your high-value flexible points are now stuck in a lower-value program.

- Ignoring Transfer Ratios: Not all partners are 1:1. Forgetting to check the conversion rate before you transfer is a rookie mistake. Capital One, for instance, has some partners with 2:1.5 or other odd ratios.

- Forgetting About Transfer Times: While many transfers are instant, some can take hours or even days. That perfect award seat could be gone by the time your miles arrive. Always verify the typical transfer time for your specific partner. A quick search on a site like AwardWallet can provide this data.

Final Thoughts: The Right Way to Combine Miles

To effectively know how to combine miles across programs (without losing value), you must shift your mindset. Stop thinking about merging miles and start thinking about consolidating purchasing power through a central hub. The most efficient system is to earn flexible credit card points, identify your desired award flight, and only then transfer the exact number of points needed from your various “hub” accounts into that specific airline’s program to make the booking.

This approach maintains maximum flexibility, protects you from devaluations, and ensures every point is deployed for maximum impact. Anything else is just inefficient. If you’re ready to get started, consider looking into the best travel rewards credit cards for 2025.

Frequently Asked Questions

Can you transfer airline miles from one airline to another?

Generally, no. Direct transfers between distinct airline programs (like United to Delta) are impossible or offer terrible rates that destroy your value. The only major exception is the Avios ecosystem: you can transfer Avios at a strict 1:1 ratio between British Airways, Qatar Airways, Iberia, and Finnair. For all other airlines, the only efficient method is to use transferable credit card points as a bridge.

What is the best way to consolidate frequent flyer miles?

The best way is to earn flexible points from programs like Chase Ultimate Rewards or Amex Membership Rewards. These points can be transferred to dozens of different airline partners, allowing you to funnel points from a central account into the specific airline program you need for a redemption.

Is it worth transferring hotel points to airline miles?

It can be, but it requires careful calculation. Programs like Marriott Bonvoy offer transfers to many airlines, but the standard 3:1 ratio is a poor value. It’s best used only to top off an airline account with the small number of miles needed for a specific, high-value award flight. Transferring large amounts speculatively is not recommended.

How do airline alliances help combine miles?

Alliances don’t let you combine or transfer miles between member airlines. Instead, they let you use one airline’s miles to book flights on another airline within the same alliance. For example, you can use your Air Canada Aeroplan points to book a flight on United Airlines because both are in the Star Alliance.