Introduction: A Common Question with a Systems-Based Answer

When you’re starting your credit journey or recovering from past mistakes, the choice between a secured and an unsecured card feels monumental. The internet is full of conflicting advice, but the core question is always the same: which one will get me to a good credit score the fastest? I’ve spent years analyzing complex systems, and a credit score is just that—a system with inputs and outputs. The type of card you use is just one small part of that system.

Let’s ignore the marketing hype and break this down logically. We’ll analyze the mechanics of each card, deconstruct how the credit scoring algorithm actually works, and then build a step-by-step action plan to use the right tool to achieve your goal in the most efficient way possible.

The System Mechanics: Secured vs. Unsecured Cards Compared

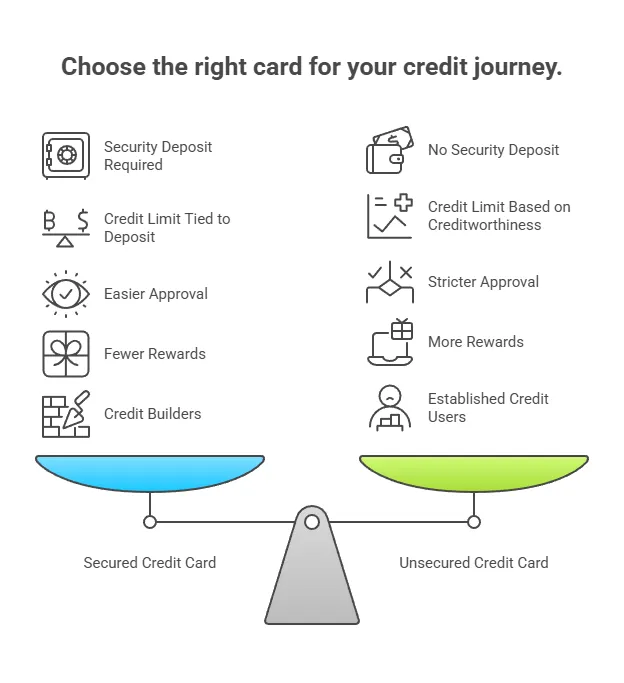

Before we can talk about speed, we have to understand the hardware. The fundamental difference between these two products is collateral. An unsecured card is a line of credit extended based on your perceived trustworthiness, while a secured card is credit extended against a cash deposit you provide.

| Feature | Secured Credit Card | Unsecured Credit Card |

|---|---|---|

| Security Deposit | Required. Typically $200-$500. This deposit is refundable when you close or upgrade the card in good standing. | Not required. Credit is granted based on your credit history and income. |

| Credit Limit | Usually equal to your security deposit (e.g., $200 deposit = $200 limit). | Varies widely based on your creditworthiness, from a few hundred to tens of thousands of dollars. |

| Approval Requirements | Easier to get approved for. Designed for people with bad credit, limited credit, or no credit history. | Requires a fair to excellent credit score. Applicants with poor credit are likely to be denied. |

| Fees & Rewards | May have annual fees. Rewards are rare but becoming more common on premium secured cards. | Can have annual fees or no annual fee. Often come with rewards like cash back, points, or miles. |

| Target User | Someone building or rebuilding their credit profile. | Someone with an established, positive credit history. |

The Core Question: Which Card Actually Builds Your Credit Score Faster?

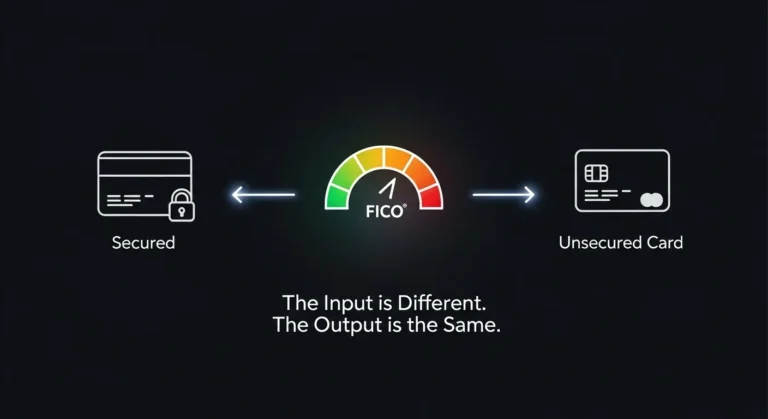

Here is the most important piece of information in this entire guide: to a credit scoring algorithm like FICO or VantageScore, a secured credit card and an unsecured credit card look exactly the same. The algorithm does not see the security deposit. It only sees a revolving line of credit.

Your credit score is primarily built on two pieces of data that both cards report to the credit bureaus every month:

- Your Payment History (35% of FICO Score): Did you pay your bill on time? This is a simple yes/no data point. Both a secured and an unsecured card will report this.

- Your Credit Utilization (30% of FICO Score): How much of your available credit did you use? This is the ratio of your statement balance to your credit limit. Both cards report this ratio. For a deep dive on this, see our complete guide to mastering your credit utilization.

Since both tools send the exact same data into the system, one cannot build credit “faster” than the other. The speed comes from perfectly executing on those two variables: always pay on time, and keep your utilization low. According to reports from Experian, payment history is the single most critical factor, and that’s something you control completely.

The Optimal Strategy: Using a Secured Card as a Launchpad

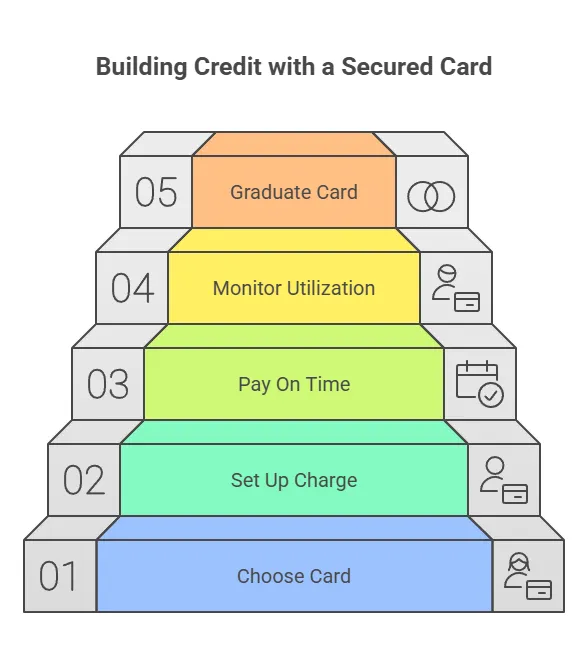

So if both cards build credit at the same rate, why choose one over the other? Because a secured card is the superior starting tool for anyone who can’t easily get approved for a good unsecured card. It’s a system designed to get you in the game. Here is the exact five-step process to use it most effectively.

Step 1: Choose the Right Tool — A Card That Reports to All 3 Bureaus and Graduates

Not all secured cards are created equal. Your number one priority is to choose a card from a major issuer (like Discover, Capital One, or a major bank) that reports your payment history to all three credit bureaus: Experian, Equifax, and TransUnion. Secondly, choose a card that has a clear “graduation” path, where the bank will automatically review your account after a period of responsible use and upgrade you to an unsecured card, refunding your deposit.

Step 2: Set It Up Correctly — Make a Small, Recurring Charge

When I started to build my credit history from scratch, I put a $10 monthly Netflix subscription on my new secured card and turned on autopay. That’s it. The goal is not to use the card for daily spending; the goal is to create a positive payment history. A small, predictable charge ensures you have something to pay off each month, generating that crucial on-time payment data point.

Step 3: Execute Flawlessly — Pay the Bill in Full and On Time

Set up autopay for the full statement balance. This guarantees you will never miss a payment. A single late payment can devastate a young credit profile and set you back months. Automating this step removes the risk of human error. This is the most important part of the entire process.

Step 4: Monitor the System — Keep Utilization Under 10%

Because secured cards have low limits, utilization is critical. That $10 Netflix charge on a $200 secured card is only 5% utilization, which is perfect. If you were to use that card for a $150 purchase, your utilization would be 75%, which would hurt your score even if you pay it in full. Keep the balance small and predictable.

Step 5: Level Up — Request to Graduate After 6-12 Months

After 6 to 12 cycles of perfect payments, your credit score will have increased. Many issuers will automatically review your account for an upgrade. If they don’t, you can call and ask. Graduating to an unsecured card and getting your deposit back is the successful completion of this credit-building mission.

Common System Faults: Mistakes That Sabotage Your Progress

- Choosing a “Fee-Harvester” Card: Be wary of secured cards from unknown issuers that come with high annual fees, application fees, or monthly maintenance fees. These products are designed to profit from your situation, not help you.

- Closing the Account Too Soon: After you graduate to an unsecured card, do not close the account. Keeping it open with no balance continues to build the age of your credit history, another important scoring factor.

- Missing a Payment: It bears repeating. A single 30-day late payment is a catastrophic failure in this system. It stays on your credit report for seven years and can drop your score by over 100 points.

Conclusion: The Card is the Tool, You Are the Builder

When it comes to Secured vs Unsecured Cards: Which Builds Credit Faster?, the answer is clear: the card itself is irrelevant to the speed. The credit bureaus don’t care if your credit line is secured by $200 of your own money or by the bank’s faith in you. They only care about the data that line of credit produces.

Your focus should not be on the type of plastic in your wallet, but on the system you implement. By using a secured card as a strategic entry point and executing a flawless process of on-time payments and low utilization, you are guaranteed to build your credit score efficiently and effectively. The power isn’t in the card; it’s in your actions.

Frequently Asked Questions

What is the main disadvantage of a secured credit card?

The main disadvantage is the opportunity cost of the security deposit. The $200-$500 you use to secure the card is tied up and cannot be used for other things until you close or upgrade the account. Additionally, secured cards typically have low credit limits and rarely offer rewards.

Can you be denied for a secured credit card?

Yes, although it’s much less common than with unsecured cards. According to credit bureau Experian, you could be denied if you have a recent bankruptcy or if the issuer cannot verify your identity. However, they are designed to be accessible, and most people who apply will be approved.

How long does it take to build a good credit score with a secured card?

If you start with no credit history and follow the steps in this guide, you can often see a “good” FICO score (in the 670+ range) within 6 to 12 months of responsible use. The first score is typically generated after about 6 months of payment history is reported.