Imagine buying a new laptop and getting not just the points from your credit card, but also a $150 statement credit and an extra 15,000 airline miles on top. This isn’t a fantasy; it’s the power of credit card stacking. This expert guide will demystify the process, showing you step-by-step how to combine offers and turn every dollar you spend into a multiplier for your travel goals. While it might sound complex, the principles of good credit card stacking are accessible to anyone willing to learn.

We’ll break down the individual layers of a successful stack, show you real-world examples of how it works, and provide the secrets you need to start maximizing your rewards today. Prepare to change the way you shop forever.

Full Comparison of Stacking Components

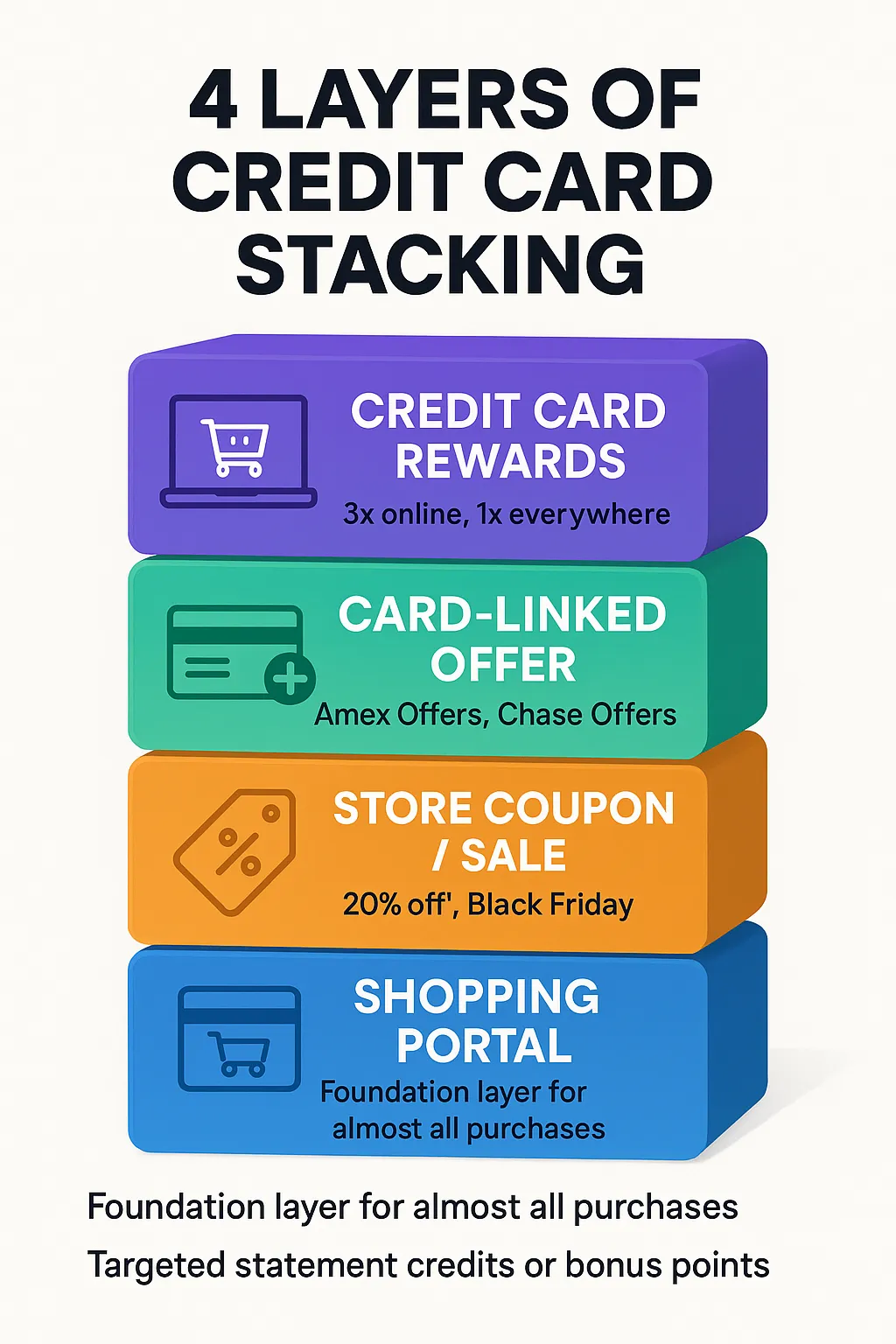

A successful stack is built with distinct layers. Understanding the role of each component is the key to constructing the most profitable combinations. Not every purchase will use all layers, but the best examples of credit card stacking often do.

| Stacking Layer | What It Is | Top Examples | Best Use Case |

|---|---|---|---|

| 1. Shopping Portal | A website that pays you a commission for clicking through to a retailer’s site before you shop. This is your foundation. | Rakuten, TopCashback, airline-specific portals (e.g., AAdvantage eShopping). | Virtually all online purchases. It’s the easiest and most consistent layer to apply. |

| 2. Card-Linked Offer | A targeted deal you add to your credit card, giving you a statement credit or bonus points for spending at a specific merchant. | Amex Offers, Chase Offers, Capital One Offers. | High-value purchases where a large statement credit can make a significant impact. |

| 3. Store Coupon / Sale | A publicly available discount, promo code, or site-wide sale offered directly by the retailer. | “20% off” codes, seasonal sales (Black Friday), first-time customer discounts. | Opportunistic. Should be applied whenever possible, but check portal terms to ensure compatibility. |

| 4. Credit Card Rewards | The base points or cash back you earn from the credit card used for the final payment. | Category bonuses (e.g., 3x on online retail), standard 1x or 2x points on all purchases. | Every single purchase. The final, essential layer of every stack. |

Category Winners: Best Stacking Scenarios

While the principles of credit card stacking can be applied anywhere, some scenarios are notoriously lucrative. Here are the winning categories where you can get the most value.

Best for Big-Ticket Electronics

Winner: The “Dell Triple Dip”

The classic example for a reason. Combining a juicy Amex Offer ($120 off $599+), a high Rakuten rate (10x-15x points), and a Dell holiday sale is a repeatable strategy that can save you hundreds on laptops and monitors.

Best for Clothing & Retail

Winner: Holiday & Seasonal Stacks

Retailers like Nike, Lululemon, and major department stores frequently have Amex/Chase Offers that can be stacked with huge portal bonuses during Black Friday or back-to-school season. Adding a site-wide sale creates an unbeatable trifecta.

Best for Travel Bookings

Winner: Hotel & Rental Car Stacks

Many hotel chains (Marriott, IHG) and rental car companies offer card-linked deals. Stacking these with a booking through the airline or hotel’s own shopping portal can earn you a statement credit plus thousands of extra miles on your stay.

Mastering Credit Card Stacking: A Step-by-Step Guide

Let’s move from theory to practice. Here is the exact process to follow to build your own powerful reward stacks.

Step 1: The Foundation – Always Start with a Shopping Portal

Never go directly to a retailer’s website. Your first click should always be through a shopping portal. These sites are the cornerstone of credit card stacking. Our favorite starting point is Rakuten, due to its reliability and the incredibly valuable option to earn Amex Membership Rewards points.

To learn the ins and outs of this specific platform, read our in-depth guide to Rakuten secrets. The most important takeaway is to switch your earning preference from cash back to Amex points, which can double or triple the value of your earnings when redeemed for travel.

Step 2: The Multiplier – Activate Your Card-Linked Offers

Before you even click through a portal, check your credit card accounts for relevant card-linked offers. Both Amex Offers and Chase Offers are found in your online account or mobile app. Simply find an offer for a merchant you plan to shop with and click “Add to Card.” This links the deal to your physical card. When you make a qualifying purchase, the statement credit is applied automatically a few days later.

Step 3: The Cherry on Top – Find a Compatible Coupon

Now that your offers are set, it’s time to find a discount from the retailer itself. Many portals, including Rakuten, have browser extensions that automatically scan for and apply the best compatible coupon codes at checkout. This is the safest way to ensure your discount doesn’t void your portal earnings.

Realistic Math Examples

Here’s how the math breaks down on a real-world purchase, demonstrating the power of a well-executed credit card stacking strategy.

Scenario 1: No Stacking

You buy a $1,000 laptop from Dell’s website, paying with a card that earns 1 point per dollar.

- Points Earned: 1,000 Amex Points

- Statement Credits: $0

- Total Value (at 1.5 cpp): $15.00

A minimal return for a major purchase.

Scenario 2: The “Triple Dip” Stack (Winner)

You buy the same $1,000 laptop, but you’re a strategic shopper. You have an Amex Offer for “$120 back on $599+” at Dell. Rakuten is offering 10x points, and Dell has a 10% off coupon code.

- Initial Price: $1,000

- Price after 10% coupon: $900

- Portal Points: $900 x 10x = 9,000 Amex Points

- Card Points: $900 x 1x = 900 Amex Points

- Amex Offer Credit: $120

- Total Points: 9,900 Amex Points

- Points Value (at 1.5 cpp): $148.50

- Total Effective Rebate: $148.50 (from points) + $120 (credit) + $100 (coupon) = $368.50

This is an incredible 36.8% effective return on your purchase.

Scenario 3: A Simple In-Store Stack

You have a Chase Offer for 10% back at Starbucks (max $5). You pay with a card linked to an airline dining program that gives you 3x miles per dollar.

- Purchase: $10

- Chase Offer Credit: $1.00

- Dining Program Miles: 30 miles

- Total Value: A dollar back and some miles on a coffee you were already buying.

Small stacks add up significantly over time.

Gotchas You Shouldn’t Ignore

This powerful technique comes with a few rules. Ignoring them can cause a stack to fail, and you’ll miss out on rewards. Here’s what to watch out for.

- Unapproved Coupon Codes: Using a coupon code not provided by or listed as compatible on the shopping portal (e.g., from a browser extension like Honey) can void your portal payout. Stick to approved codes.

- Forgetting to Activate: A card-linked offer does nothing if you don’t add it to your card before you shop. Always double-check that it’s linked.

- Product & Category Exclusions: Read the fine print. An Amex Offer might be for “Dell.com” but exclude their outlet store. A portal may exclude gift cards or new products.

- Returns Lead to Clawbacks: If you return the item, you lose the rewards. All of them. The statement credit will be reversed, and the portal points will be removed from your account.

How We Picked These Strategies

The credit card stacking methodologies in this guide were selected based on real-world testing and three key criteria: Value, Repeatability, and Accessibility. We focused on strategies that provide outsized returns (like the Dell stack) but are also repeatable throughout the year. We prioritized using mainstream tools like Rakuten, Amex Offers, and Chase Offers that are accessible to a wide range of consumers. All valuations are based on real-world data and the conservative methodologies outlined in our Complete Guide on Maximizing Points and Miles.

FAQ

Is credit card stacking legal and within the rules?

Absolutely. You are simply using multiple, separate loyalty programs and offers, all of which you are entitled to use. You are not breaking any terms of service. The key is to follow the rules of each individual program (e.g., using approved coupon codes).

Can you combine multiple Amex Offers on one purchase?

No. You can only have one Amex Offer for a specific merchant linked to a single card at a time. Once you use it, it’s gone. However, if you have the same offer on two different Amex cards, you could split a purchase to use it twice (if the retailer allows split payments).

What is the best credit card for this strategy?

American Express cards are generally the best for this because Amex Offers are often more lucrative than those from other banks, and the ability to earn Membership Rewards via Rakuten is a huge advantage. Cards like the American Express® Gold are particularly powerful. You can see a full comparison in our review of the best credit cards for rewards.

How do I keep track of all these different offers?

It can be a challenge. Many enthusiasts use a simple spreadsheet to track which Amex/Chase offer they’ve added to which card. For shopping portals, using a browser extension is the best way to get automated alerts so you don’t forget that crucial first click.