How a Credit Card Works: The System Behind the Swipe

So, what is a credit card in practical terms? It’s a physical or digital card that lets you buy things now with a promise to pay later. When you swipe, tap, or enter your card number online, you’re not spending your own cash. Instead, the bank that issued your card pays the merchant on your behalf, creating a debt that you owe the bank. For beginners, understanding that you’re taking on a short-term loan with every purchase is the most critical concept.

The entire transaction process is a rapid, four-step data exchange that happens in seconds. Think of it as placing an order at a restaurant: you ask for something, the kitchen confirms they can make it, they serve you, and later you get the bill.

Here’s how it works in practice:

- You Initiate the Purchase. You swipe your card, tap it, or enter the details online. The merchant’s terminal (the payment system) securely sends your card information and the purchase amount to their bank, known as the acquirer. This is why chip cards are more secure than swiping, the chip creates a unique transaction code that can’t be reused.

- The Request is Authorized. The merchant’s bank routes the request through the card network (like Visa or Mastercard) to your bank (the issuer). Your bank’s system instantly checks if you have enough available credit and if the transaction seems legitimate. If everything checks out, it sends an authorization approval back.

- The Merchant Gets Paid. The approval is your green light to complete the purchase. The money isn’t actually transferred yet, but the bank has guaranteed the payment. At the end of the business day, the merchant’s bank will formally request the funds from your bank in a batch settlement.

- You Get the Bill. The transaction is posted to your credit card account. At the end of your billing cycle, all your purchases are compiled into a statement. You then have a grace period (usually 21-25 days) to pay the bank back. Pay the full balance, and you pay no interest. Pay less, and interest accrues on the remaining amount.

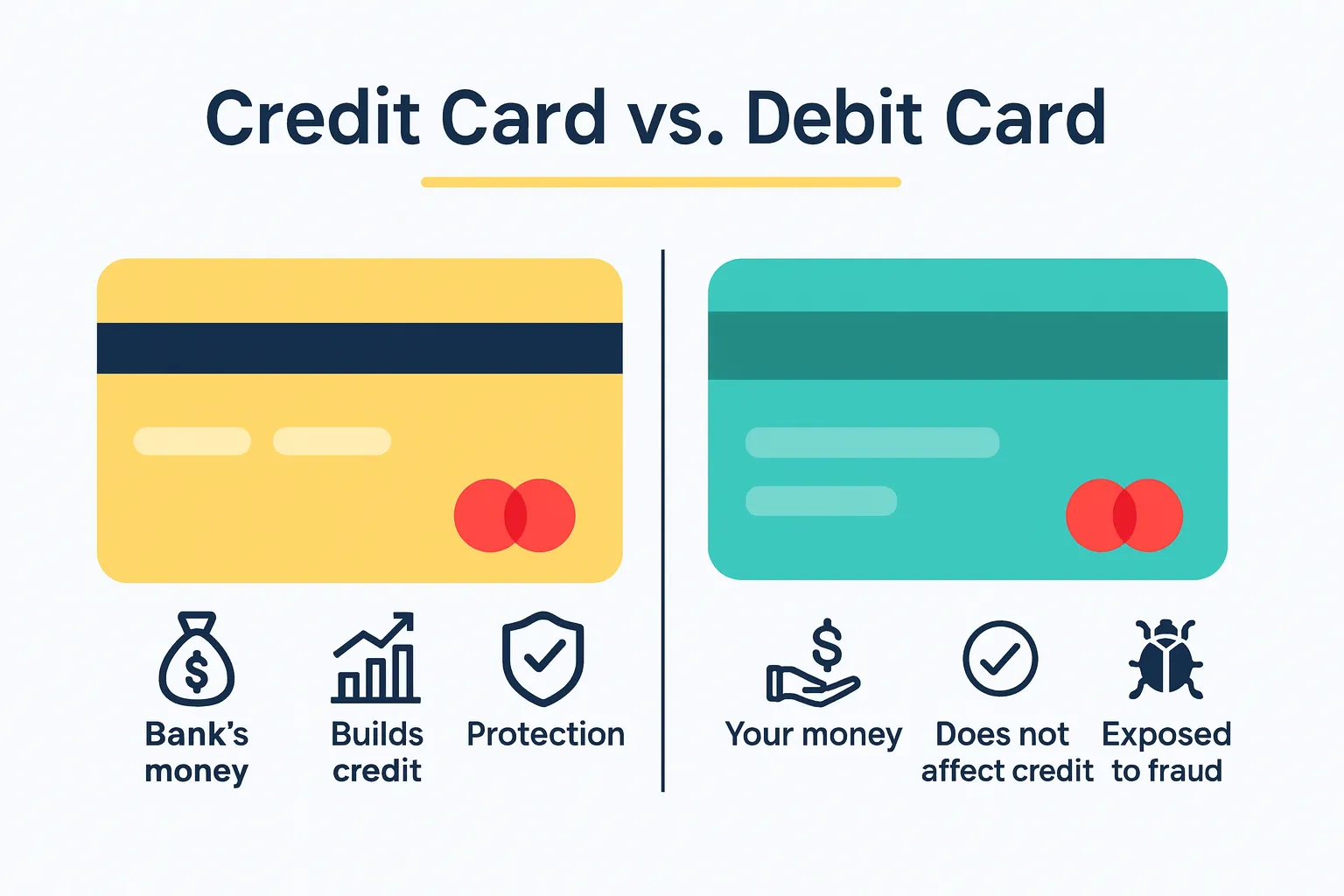

Credit Card vs. Debit Card: Your Money vs. The Bank’s

The most common point of confusion for beginners is the difference between a credit card and a debit card. They may look the same, but they function in fundamentally opposite ways. One uses your money, the other uses the bank’s.

| Payment Method | Source of Funds | Impact on Credit Score | Fraud Liability | Best For |

|---|---|---|---|---|

| Credit Card | Borrowed money (a credit line) from the issuing bank. You pay it back later. | Builds your credit history. On-time payments are reported to credit bureaus, which can significantly raise your score. | Excellent. You are typically liable for a maximum of $50, and often $0, for fraudulent charges. The bank’s money is at risk, not yours. | Online shopping, travel, large purchases, recurring bills, and building a credit history. |

| Debit Card | Your own money, withdrawn directly from your checking account at the time of purchase. | No impact. Since you’re not borrowing money, your activity is not reported to credit bureaus. | Weak. Your actual cash is withdrawn by the fraudster. While you can report it, getting your money back can be a slow, difficult process. | ATM cash withdrawals and everyday spending if you struggle with debt. |

The real-world difference in security is massive. On a trip to Barcelona, my credit card details were stolen and used for a $1,200 online purchase. I reported it, the bank erased the charge, and I never lost a dime. It was a 5-minute phone call. If that had been my debit card, $1,200 would have been drained from my checking account, and I would have been fighting for weeks to get my own money back. This is why I never use a debit card for online purchases.

The Strategic Advantages of Using a Credit Card

#1 Advantage: Building Your Credit Score

This is the single most important financial reason to use a credit card. Your credit score is a number that tells lenders how reliable you are at repaying debt. A high score unlocks lower interest rates for major life purchases like a car or a home, saving you thousands of dollars. Using a credit card responsibly is the fastest and most effective way to build that score from scratch. My credit score increased by over 50 points in the first 24 months of responsible credit card use.

#2 Advantage: Unmatched Fraud Protection

A credit card acts as a digital firewall between a merchant and your actual cash. If a fraudulent charge appears, you can dispute it, and the bank will investigate while you owe nothing. With a debit card, your money is gone instantly. The legal protections for credit cards are simply stronger, making them the only logical choice for online transactions. Federal Trade Commission on Fraud Liability confirms these protections.

#3 Advantage: Earning Rewards on Spending

Why not get something back for the money you’re already spending? Rewards cards offer either cash back or travel points on every purchase. Simple cash back cards can save you hundreds of dollars a year, while travel cards can unlock incredible experiences for pennies on the dollar. I fly business class since many years, just recently saved $4,000 on a long-haul trip to Asia.

Understanding the Key Features of a Credit Card

When you’re comparing cards, you’ll see a lot of jargon. As an IT manager, I think of these as the technical specifications. Here are the only ones that really matter for a beginner.

APR (Annual Percentage Rate)

This is the interest rate charged on any balance you don’t pay off by the due date. If you pay your statement in full every month, your APR is irrelevant. If you carry a balance, a high APR is financial poison. The average credit card APR is currently ~24%, which is incredibly expensive.

Annual Fee

Some cards, especially premium travel cards, charge a yearly fee just for having the card. This fee is only worth it if the value of the card’s perks (like free hotel nights or airline credits) is greater than the cost of the fee. For beginners, a card with a $0 annual fee is the best place to start.

Credit Limit

This is the maximum amount of money the bank will let you borrow. It’s not your money; it’s a limit. Using too much of your credit limit (a high “credit utilization ratio”) can hurt your credit score. A good rule of thumb is to keep your balance below 30% of your limit. If your limit is $1,000, try to never have a statement balance over $300.

Sign-Up Bonus

This is a one-time reward (like $200 cash back or 50,000 miles) that issuers offer to new cardholders who spend a certain amount of money in the first few months. This is often the single most valuable perk of getting a new card.

Gotchas You Shouldn’t Ignore

- Minimum Payments Are a Debt Trap. Paying only the minimum is designed to keep you in debt for as long as possible while maximizing the bank’s profit from interest. Always, always pay the full statement balance.

- Cash Advances Are Financial Emergencies Only. Using your credit card to get cash from an ATM comes with a separate, sky-high APR that starts accruing interest instantly. There is no grace period. Avoid this at all costs.

- A Due Date is a Hard Deadline. A single late payment can trigger a fee (typically $25-$40) and, if it’s over 30 days late, will seriously damage your credit score for years. Set up automatic payments for at least the minimum amount as a safety net. Make sure you have everything planned, consider using calendar entries to remind yourself.

How This Guide Was Written

This guide is the product of over a decade of hands-on experience managing a complex system of personal and business credit cards to maximize value and build credit. The definitions and advice are based on analyzing the terms and conditions of dozens of cards from major issuers. All concepts have been cross-referenced with official resources from government agencies and the banks themselves.

What This Means For You

Now that you have a clear answer to “What Is a Credit Card?”, you can see it’s a powerful tool for building wealth and security, but only if you follow one simple rule: pay your statement balance in full, every single month. For most beginners, the best default choice is a no-annual-fee cash back card. Once you’ve mastered that, you can explore more complex rewards. To see which type of card fits you best, start here.

FAQ

What is the difference between Visa, Mastercard, and American Express?

Visa and Mastercard are payment networks that partner with banks (like Chase or Citi) to issue cards. American Express is both a network and its own bank. For you as a consumer, the main practical difference is that Visa and Mastercard are accepted almost everywhere, while Amex is slightly less common, especially outside the U.S. The rewards and benefits are determined by the bank, not the network.

Does applying for a new credit card hurt my credit score?

Yes, but only slightly and temporarily. When you apply, the lender performs a “hard inquiry” on your credit report, which can cause a small dip of a few points. This is a normal part of building credit and the impact fades within a few months. For an official explanation, see the FICO Guide to Inquiries.

What is the best type of credit card for a beginner?

A no-annual-fee cash back card is the perfect starting point for most beginners. It’s simple to understand, rewards you for your spending, and helps you build a positive credit history without any costs. My recommended starter card for friends and family is always a flat-rate 1.5% or 2% cash back card.