Rewards stacking is one of the most powerful — and underused — personal finance hacks. Instead of getting just a few points on your credit card, you can layer portals, apps, offers, and coupons to earn multiple streams of value on a single transaction. This guide breaks down rewards stacking step by step, with real-world examples, top tools, and essential rules to follow so you never miss out on savings again.

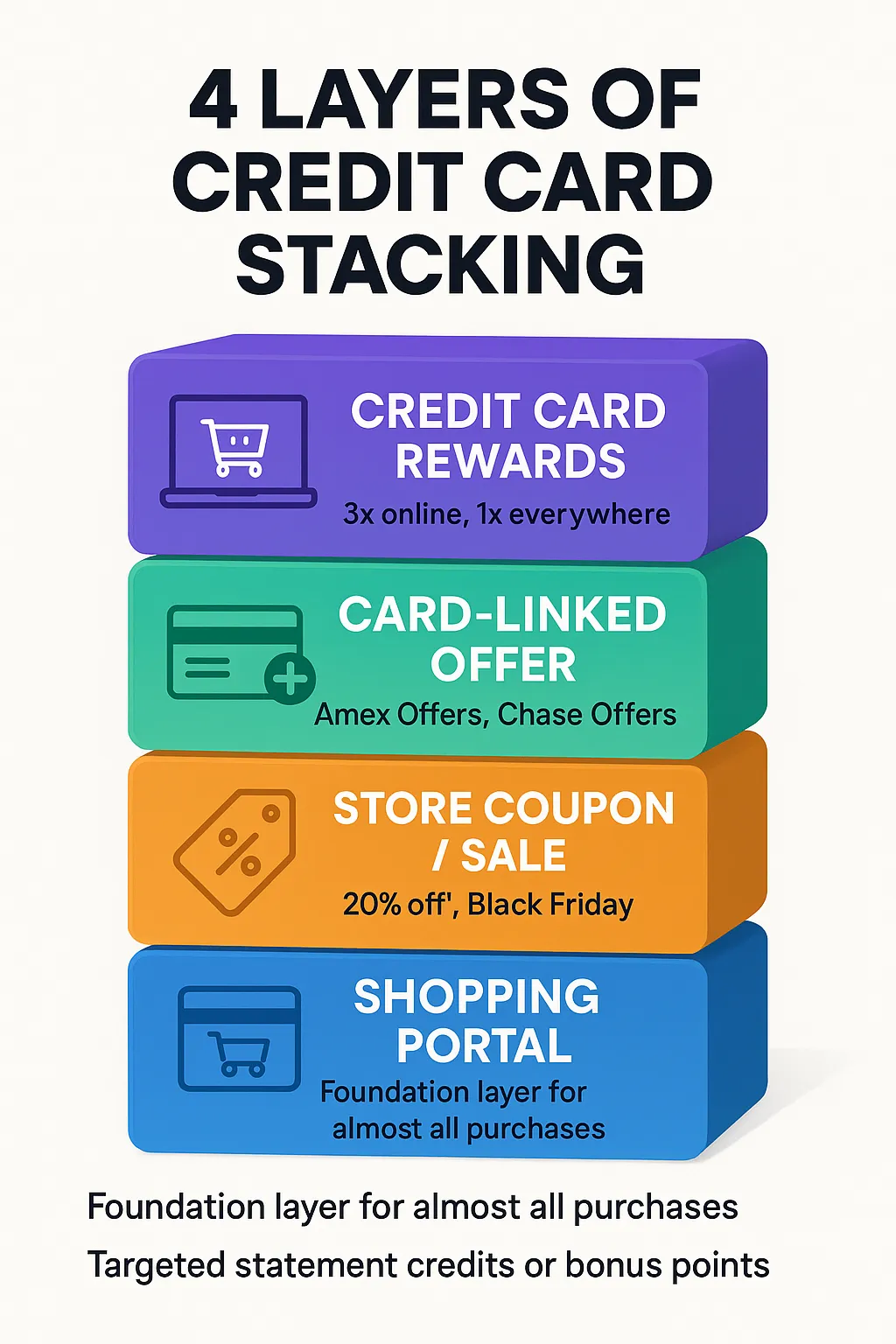

The 4 Core Layers of Rewards Stacking

Think of every purchase like a cake. The more layers you add, the bigger your reward. Here are the essential components that form the foundation of rewards stacking.

| Stacking Layer | What It Is | Top Examples | Best Use Case |

|---|---|---|---|

| 1. Shopping Portal | A website that rewards you for clicking through before you shop. This is the foundation layer. | Rakuten, TopCashback, airline/hotel portals. | Most online purchases; always start here. |

| 2. Store Coupon / Sale | Publicly available discounts, promo codes, or seasonal sales. | 20% off coupons, Black Friday, first-time buyer offers. | Stack whenever available, but check portal terms to avoid disqualification. |

| 3. Card-Linked Offer | A targeted deal tied to your credit card that gives statement credits or bonus points. | Amex Offers, Chase Offers, Capital One Offers. | High-value purchases where large credits make a big impact. |

| 4. Credit Card Rewards | The base points or cash back you earn from your credit card on the final payment — ideally from credit cards with cash back that earn 2%+ everywhere or category bonuses. | 3x online, 4x dining, 1x everywhere else. | Every transaction; the top layer on all stacks. |

Best Stacking Categories

Some categories are especially rewarding when stacking offers. Here are the standouts.

Electronics

Dell Triple Dip — Stack a Rakuten portal bonus, an Amex Offer, and a Dell coupon during seasonal sales for savings over 30% on laptops and monitors.

Everyday Shopping

Combine Ibotta or Fetch Rewards with a card-linked grocery offer and your credit cards with cash back for consistent savings on essentials.

Travel & Dining

Use a hotel or airline shopping portal, stack it with a dining rewards program, and pay with a high-earning travel card. Add Amex or Chase Offers for bonus credits.

Step-by-Step: How to Stack Rewards Like a Pro

Step 1: Start With a Portal

Always begin your shopping through a portal. Our in-depth Rakuten guide shows how to switch earnings from cash back to Amex Membership Rewards for outsized value. TopCashback and airline portals are also excellent options.

Step 2: Add Card-Linked Offers

Check your Amex, Chase, or Capital One dashboard for relevant offers. Link them before you shop. These credits or bonuses stack seamlessly on top of portals.

Step 3: Layer in Coupons or Discounts

Browser extensions like Honey or Capital One Shopping automatically test codes. Rakuten and TopCashback often highlight compatible coupons directly on their sites so you don’t accidentally void portal earnings.

Step 4: Pay With the Right Credit Card

Maximize your rewards by using credit cards with cash back or strong category multipliers. Pair a 2%+ cash-back card for general purchases with a dining or grocery bonus card for category spend. For a deeper dive into point values and redemptions, see our complete guide to maximizing points & miles.

Real Math Examples

Simple Purchase

$100 clothing order direct from retailer with a 2% cash back card.

- Card Rewards: $2

- Total Value: $2 (2%)

Baseline without stacking.

Stacked Purchase

$100 clothing order via portal (10%), with a 10% card-linked offer, plus 2% from credit cards with cash back.

- Portal: $10

- Card-Linked Offer: $10

- Card Rewards: $2

- Total Value: $22 (22%)

Representative of everyday “double-dip + card” stacks.

Grocery + App Stack

$50 grocery order, with Ibotta $5 offer, 5x points credit card, plus Fetch Rewards (500 pts ≈ $0.50).

- Ibotta: $5

- Card Rewards: 250 pts (~$2.50)

- Fetch: ~$0.50

- Total Value: ~$8 (~16%)

Small stacks compound over a month.

Additional Stacking Tools

- Upside: Cash-back app for gas, groceries, and dining. Claimed offers expire quickly (e.g., 4–24 hours), so plan your timing.

- Ibotta: Add offers pre-shop, then upload receipts or link loyalty accounts for automatic cash back.

- Fetch Rewards: Upload receipts for points redeemable for gift cards. Low per-receipt value, but effortless and cumulative.

- Dining Rewards Programs: Airline and hotel dining networks give bonus miles or points automatically when paying with a linked card.

- Bilt Rewards: Earn points for rent, dining, Walgreens purchases, select fitness classes, and travel — with strong transfer partners.

- Browser Extensions: Honey, Capital One Shopping, Rakuten, and TopCashback extensions test codes and surface cash-back prompts automatically.

Common Pitfalls to Avoid

- Unapproved Coupons: Some codes void portal rewards — stick to the ones listed on the portal page.

- Forgetting to Activate: Card-linked offers must be added to your card before checkout.

- Exclusions & Fine Print: Gift cards, outlet stores, or certain SKUs may be excluded from offers or portal payouts.

- Returns = Clawbacks: If you return an item, expect any credits and portal rewards to be reversed.

Our Methodology

These rewards stacking strategies come from hands-on testing across major U.S. portals, card-linked ecosystems, and receipt apps. We prioritize stacks that are repeatable, high-value, and accessible. Valuations assume a conservative 1.5¢ per point for transferable currencies (e.g., Amex Membership Rewards or Chase Ultimate Rewards). For deeper strategies on redemptions and point values, revisit our Maximizing Points & Miles guide and portal-specific tactics in Rakuten secrets. When possible, pair these tactics with credit cards with cash back to lock in guaranteed value even when portal rates are low.

FAQ

Is rewards stacking legal?

Yes. Rewards stacking is completely legal because you are simply combining separate loyalty programs, card-linked offers, and coupons. As long as you follow each program’s terms of service, you are well within the rules.

What are the best credit cards with cash back for stacking?

The best credit cards with cash back are those that earn at least 2% everywhere (like Citi® Double Cash or Wells Fargo Active Cash®) or offer high category bonuses (like 4% dining, 3% groceries). These cards guarantee value while still letting you layer portals and offers on top.

Can I use multiple card-linked offers at once?

No. Each purchase can only trigger one offer per card. However, if you hold multiple cards with the same offer (e.g., Amex Offers), you can split the transaction across them if the merchant allows it.

How do I keep track of all stacking opportunities?

Many enthusiasts use spreadsheets to track card-linked offers and browser extensions for portals. Apps like Cashback Monitor and AwardWallet also help by comparing portal rates and reminding you of linked offers.

Does stacking work with travel bookings?

Yes. You can often stack a shopping portal with a hotel or airline, add a card-linked offer (like Amex Offers for Marriott), and still earn your regular credit card rewards. Using credit cards with cash back ensures you get guaranteed value even on discounted bookings.